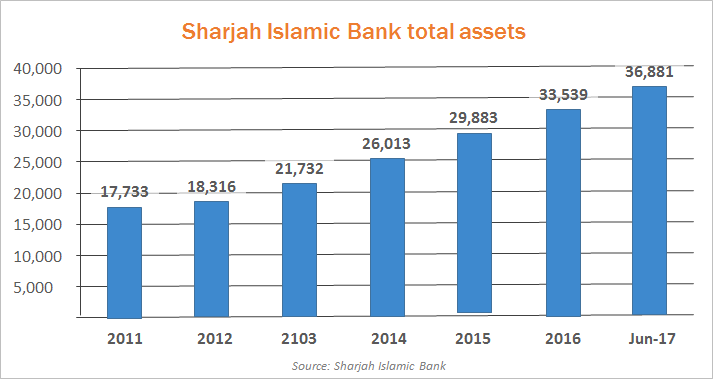

Sharjah Islamic Bank (SIB) this week announced a net profit of AED 272.9 million (US$ 74.8m) for the first half of 2017, reporting a 6.2 percent increase on the AED 257.0 million (US$ 70.4m) net profit posted for the same period in 2016. SIB also reported a 10 percent increase in total assets, showing AED 36.9 billion (US$ 10.1b) in total assets at the end of H1 2017, compared to AED 33.5 billion (US$ 9.2b) at the end of 2016. The half-yearly results were published in a statement to the bank’s shareholders.

One of four banks incorporated in Sharjah, Sharjah Islamic Bank is listed on the Abu Dhabi Securities Exchange (ADX) under the symbol SIB. The bank enjoys strong capitalisation, a strong liquidity position and is rated BBB+ with a stable outlook by global credit rating agency FitchRatings. SIB reported a 9 percent increase in net profit for 2015 and a 13 percent increase for the year 2017.

SIB is strongly capitalised, with total shareholder equity reaching AED 5.1 billion (US$1.4b) or 13.9 percent of total assets by the end of H1 2017, with a strong capital adequacy ratio of 20.61 percent. Meanwhile, Net Operating Income increased 10.2 percent, hitting AED 480.1 million (US$ 131.5m) at the end of the first half of 2017 compared to AED 435.5 million (US$ 119.3m) in the first half of 2016.

The bank’s total assets reached AED 36.9 billion (US$ 10.1b) at the end of H1 2017 compared to AED 33.5 billion (US$9.2b) at the end of 2016. The bank reported liquid assets at AED 8.4 billion (US$ 2.3b) or 22.8 percent of the Balance Sheet, underscoring SIB’s strong liquidity position and the financial strength.

Sharjah Islamic Bank’s deposits increased by 20.3 percent, growing by AED 3.8 billion to a total of AED 22.1 billion (US$ 6.0b) by the end of the second quarter of 2017, compared to AED 18.3 billion (US$5.0b) at the end of 2016. Net customer receivables of the bank grew by 11.2 percent to total AED 19.0 billion (US$ 5.2b) at the end of June,

According to the bank’s statement, investment securities increases by 20.1 percent to reach AED 4.9 billion (US$ 1.3b) at the end of the first half of 2017, compared with AED 4.1 billion (US$1.1b) at the end of December 2016.

Sharjah Islamic Bank successfully issued an unsecured US$ 500 million (AED 1.8b) 5-year sukuk last September, listing the bond on the Nasdaq Dubai financial exchange. In a bourse statement issued in March of this year, the bank informed shareholders of plans to issue a convertible sukuk equivalent to 10 percent of the bank’s capital.

Source: SIB